On-chain data shows yesterday’s Bitcoin crash from $27,300 to $25,800 alone sent 6.5% of the supply into a state of loss.

Bitcoin Supply In Profit Shrunk Down To 62.5% Following The Price Plunge

According to data from the on-chain analytics firm Glassnode, a further 1.26 million coins were lost after the latest price plummet. The relevant indicator is the “percent supply in profit,” which measures the percentage of the total circulating Bitcoin supply currently being held at a profit.

The metric calculates this value by going through the on-chain history of all the coins on the network to see what price they were last moved at. If the previous selling price for any coin was less than the current spot value of the asset, then that specific coin is counted inside the profit supply.

The counterpart indicator for the percent supply in profit is the “percent supply in loss,” which naturally tracks the loss of supply. This metric’s value can be found by subtracting the percent supply in profit from 100.

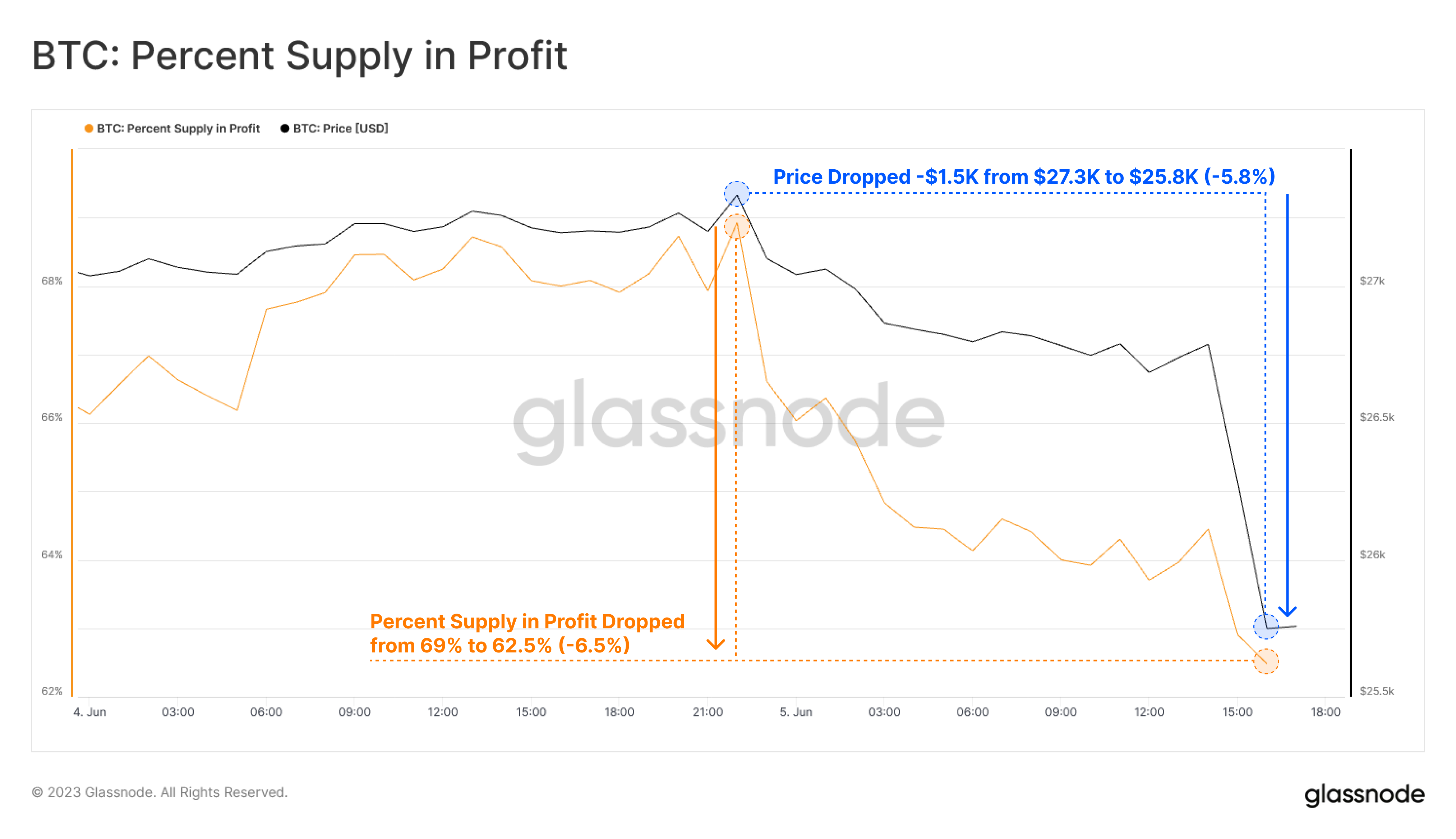

Now, here is a chart that shows the trend in the Bitcoin percent supply in profit over the last couple of days:

The value of the metric seems to have observed some decline recently | Source: Glassnode on Twitter

As displayed in the above graph, the Bitcoin percent supply in profit saw a massive plunge as the crash in the cryptocurrency from the $27,300 mark to the $25,800 level took place.

The impetus behind this price plunge was the US Securities and Exchange Commission (SEC) suing the cryptocurrency exchange Binance and its CEO, Changpeng Zhao, over alleged fraud.

Though even though the price saw a 5.8% plunge during this crash, the percentage of the total circulating Bitcoin supply that was sent into a state of loss measured to around 6.5%.

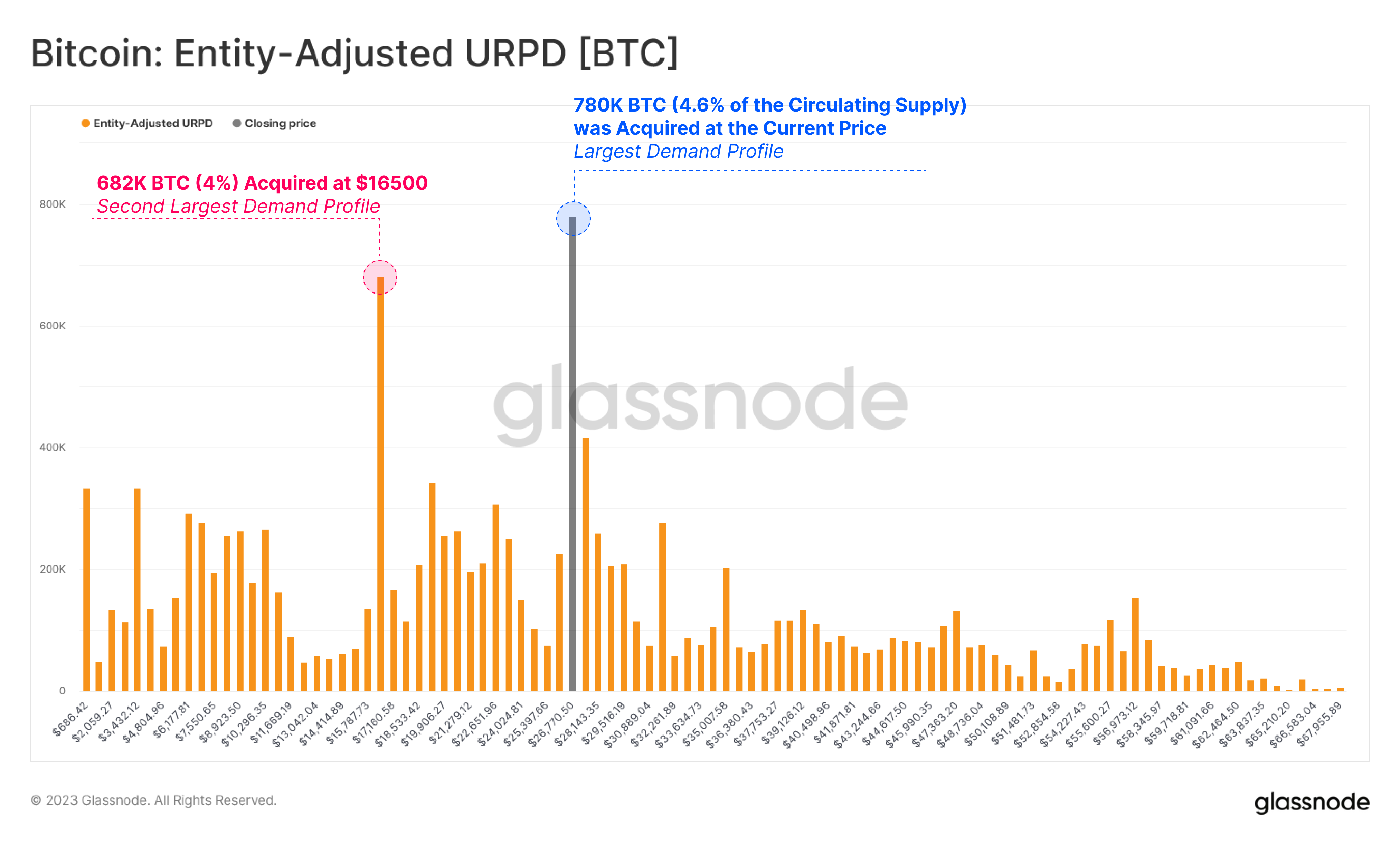

The analytics firm also explained the reason behind this discrepancy; the price range that the asset had previously been trading in was host to many investors’ cost basis (that is, the acquisition/buying price).

Looks like the prices that BTC had been trading at before were the center of the largest demand profile | Source: Glassnode on Twitter

Since a relatively high percentage of the supply had been bought at those levels, it makes sense that a sharp price move below it would send a significant number of coins into a loss.

When Bitcoin had been trading around the $25,800 level, the percent supply in profit had dropped to just 62.5%, while preceding the crash, the indicator had a value of about 69%. This would imply that 37.5% of the supply had been lost after the plunge.

Since Glassnode posted the chart, however, the cryptocurrency has recovered, pushing back above the $26,000 level. Naturally, this means that some coins would have returned to a profit state.

BTC Price

At the time of writing, Bitcoin is trading around $26,100, down 4% in the last week.

BTC has sharply risen during the last few hours | Source: BTCUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com