Data shows Bitcoin has been stuck in a historically tight 14-day range recently, something that has decompressed into big moves in the past.

Bitcoin 14-Day Range Has Been Extremely Narrow Recently

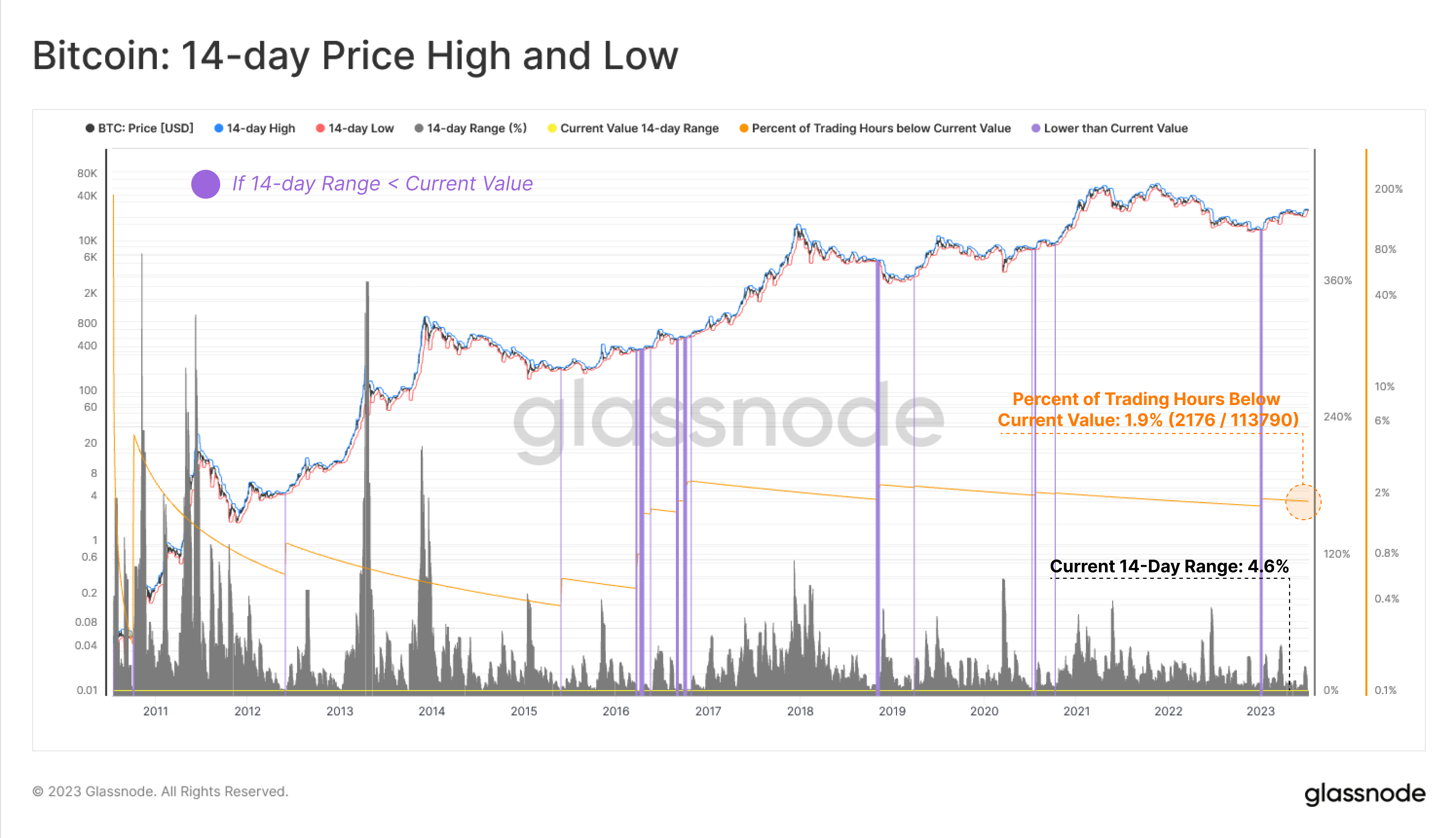

According to data from the analytics firm Glassnode, the 14-day range has only been narrower than now during less than 2% of the cryptocurrency’s entire trading life. The “14-day range” here refers to the percentage difference between the top and bottom recorded in the Bitcoin price during the past two weeks.

This indicator can tell us about how volatile the asset’s price has been recently. When its value is high, it means that the coin has observed a large amount of fluctuation within the last fourteen days, and thus, the price has registered high volatility.

On the other hand, low values of the metric imply the cryptocurrency hasn’t been that volatile as its price has moved by only a low percentage during the past couple of weeks.

Now, here is a chart that shows the trend in the Bitcoin 14-day range over the entire history of the asset:

Looks like the value of the metric has been quite low in recent days | Source: Glassnode on Twitter

As highlighted in the above graph, the Bitcoin 14-day range is currently at a value of just 4.6%, which means that the local high and low within the past two weeks have differed by just 4.6%.

This is an extremely low value when compared to what has generally been the norm for BTC. In the chart, Glassnode has also marked the instances where the indicator has observed even lower values than right now.

As can be seen from the purple bars, there have only been very few occurrences where Bitcoin has traded inside a narrower range. In terms of the numbers, only 2,176 hours in the lifetime of the asset have registered lower values of the metric, which are equivalent to about 1.9% of the entire trading life of the oldest cryptocurrency.

An interesting pattern has historically followed whenever the indicator has recorded such low values of the 14-day range. From the graph, it’s visible that Bitcoin has usually succeeded in these periods of extremely low volatility with a violent move.

This violent move can be towards either direction, as both crashes and rallies have followed a narrow range. Though, curiously, the majority of these moves have been towards the upside.

The latest occurrence of this pattern was way back in January, right before the current rally initially started. It would appear that back then as well, the tight range exploded into a sharp upwards move.

If history is anything to go by, the current low values of the 14-day range may mean that another sharp Bitcoin move may be likely to take place in the near future. And naturally, if precedence is to consider, such a move may be more probable to be towards the up direction.

BTC Price

At the time of writing, Bitcoin is trading around $30,900, up 1% in the last week.

BTC appears to be surging | Source: BTCUSD on TradingView

Featured image from André François McKenzie on Unsplash.com, charts from TradingView.com, Glassnode.com