In light of a recently published real estate listing, former FTX CEO Sam Bankman-Fried (SBF) is reportedly selling a 12,000-square-foot penthouse in the Bahamas for $39.9 million. Moreover, reports further detail that FTX Property Holdings spent roughly $74 million on real estate purchases in the surrounding Albany Bahamas oceanside district.

Bahama Mansion Called the ‘Orchid Building’ Listed for Close to $40 Million

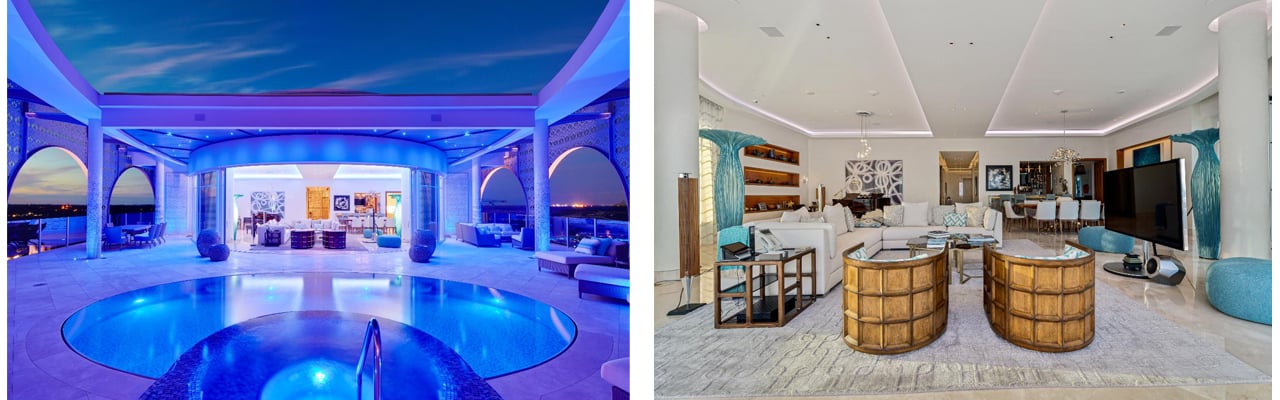

This past weekend, the web portal seasidebahamas.com published a real estate listing that’s reportedly tied to the former FTX CEO Sam Bankman-Fried (SBF). The property dubbed the “Orchid Building,” is located on a 600-acre oceanside resort community called Albany Bahamas or Albany Resort.

The asking price for the 12,000-square-foot penthouse is roughly $39.9 million, according to the listing, and the so-called effective altruist SBF’s maintenance fees for the home are around $21,000. SBF’s penthouse listing made waves on Twitter when it was shared by the Twitter account dubbed “Autism Capital.”

A large portion of the commenters on Autism Capital’s thread mentioned SBF’s so-called altruistic nature he boasted about on a regular basis. “Effective altruism housing,” one person mocked in the Twitter thread. “That mansion screams effective altruism,” another person wrote.

Report Says FTX Property Holdings Spent $74 Million on Real Estate in the Bahamas, FTX Purchased Real Estate in Tokyo, Miami’s Brickell Financial District

In addition to the Albany district mansion, a report published by The Block indicates that FTX allegedly spent $74 million on real estate purchases in the Bahamas. Reporters Kollen Post and Frank Chaparro witnessed documents that show “FTX Property Holdings spent $74,230,193 on property in the Bahamas over 2022.”

if people like new office videos..

about a month out from moving into our new Tokyo office pic.twitter.com/o3bGbqxKtr

— FTX (@FTX_Official) November 7, 2022

The report further details that $67.4 million went to properties in the Albany Bahamas district. In addition to Albany properties, the report says SBF purchased a condo at One Cable Beach for $2 million. FTX’s subsidiary FTX Property Holdings is mentioned in the company’s bankruptcy protection filing registered in Delaware.

FTX also purchased real-estate in Miami Florida as reports detail that FTX was building a “permanent space with capacity for 16 to 18 employees.” The FTX office was located in Miami’s Brickell financial district and the company also shared a video of a new Tokyo office on Nov. 7, 2022, days before its bankruptcy filing.

What do you think about the real-estate purchases FTX Property Holdings reportedly made during the last few years? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.