Since bitcoin’s price was first measured in fiat value in 2010, only four out of the 11 Novembers in bitcoin’s history have seen monthly declines. Eight of the Novembers in bitcoin’s price history saw bitcoin climb higher from the first of the month to the last day of November. Following the collapse of FTX, an event that took place immediately after the first week of the month, it looks as though bitcoin’s price in November 2022 has a high probability of ending with negative percentages against the U.S. dollar.

Bitcoin in November

Things were looking on the upside, as far as bitcoin’s price is concerned, a week before the FTX fiasco, as the leading crypto asset was trading above the $20K zone. On the first of November, bitcoin (BTC) was changing hands for $20,485 per coin.

Since Nov. 9, 2022, BTC’s price is close to $4K below that range at $16,664 per unit. Now that there’s less than two weeks left in November, in order for BTC’s price to rise above what it lost, it needs to cross the $20,500 range or higher by Nov. 30, 2022.

That means in order for bitcoin’s November price to join the eight previous November bulls, between now and the end of November, BTC needs to rise 18.7% against the U.S. dollar. On Nov. 1, 2010, bitcoin started the month at $0.19 per token and by the end of November, it was $0.23.

November 2010 was a 21.05% increase, even though BTC’s price only moved four cents higher than at the beginning of the month. 2011 was the first November when BTC was down by the end of the month.

Bitcoin started at $3.25 per unit on Nov. 1, 2011, and by the last day of November, it was down 15.38% and trading for $2.75. The following year in 2012, the price per bitcoin in November increased by 11.16% against the U.S. dollar.

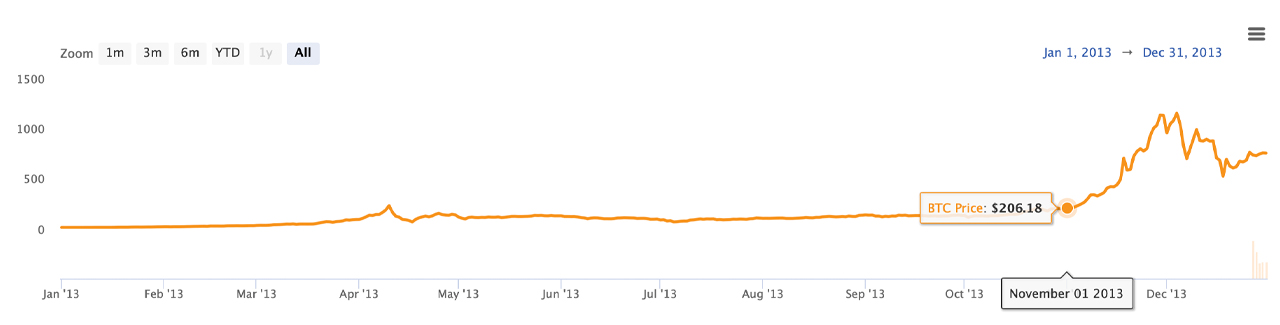

On Nov. 1, 2012, BTC was $11.20 per coin and on Nov. 30, 2012, the price per bitcoin was $12.45. In November 2013, BTC jumped a whopping 447% against the greenback that month. At the time, the price rose from $206.18 per BTC to $1,129 a bitcoin.

November 2014 was also a positive month for BTC, but not nearly as high as the year prior. Bitcoin jumped 16% higher from $325.89 per unit to $378.05 a token. Bitcoin’s USD value in November 2015 was almost identical to 2014 and the price increase was as well.

BTC jumped 14% higher from $325.43 a token on Nov. 1, 2015, to $371.29 per unit by the month’s end. Both 2016 and 2017 November BTC prices were positive as well. During the first week of November 2016, BTC was exchanging hands for $711.52, and by the month’s end, it was 2.88% higher at $732.03.

November 2017 was a bigger jump (25.96%) from $7,407.41 per BTC, to the month-ending price of $9,330.55 per BTC. Both 2018 and 2019 November BTC prices saw declines yielding negative percentages.

In November 2018, bitcoin slipped from $6,376.13 per unit to $4,009.97, losing 37% that month. In November 2019, BTC’s USD value dropped from $9,235.35 per unit to $7,047.92 per bitcoin, sliding 23.68% lower.

November’s 2020 BTC prices moved upwards from $13,737.11 on Nov. 1, to $18,177.48 by the month’s end. Bitcoin’s price in November 2020 moved 32.32% higher. Bitcoin’s USD value in November 2021 saw the price tap BTC’s lifetime high against the greenback at $69,044 per unit on Nov. 10, 2021.

However, BTC started the month at $63,326.90 and ended November at $57,248.46 per BTC, losing 9.59% during the course of the month. From the current looks of things, it seems like the probability of November 2022 joining the past four red months during BTC’s lifetime of recorded value is much higher.

18.7% is a pretty high climb from here but in the world of crypto, it’s not out of the ordinary either. Overall, 2022 has been a lower year, in general, in view of BTC’s value against the dollar losing 63.77% since the first week of January 2022.

What do you think about bitcoin’s price performance in November 2022 compared to all the past November performances in bitcoin’s history? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.