In the midst of the banking upheaval in the United States, Google Trends has revealed a notable surge in searches related to the acquisition of gold, with the search query reaching a perfect score of 100 during the first week of April 2023. Similarly, the search term “how to buy bitcoin” reached the same score two weeks earlier, on March 20, 2023.

90-Day Stats From Google Trends Highlight Interest in How to Buy Gold and Bitcoin

Over the past six months, the value of gold has soared by an impressive 20%, with a single troy ounce of .999 fine gold currently changing hands for $1,998 per unit. As for bitcoin (BTC), it is presently trading at just under $30K per unit, having risen by 8.9% in the last 24 hours as of April 26, 2023. Both gold and bitcoin have experienced an upsurge in value following the banking crisis of mid-March, which witnessed the collapse of three major U.S. banks. Market observers are now keeping a close watch on the First Republic Bank fiasco, as it lost over 50% of its value during Tuesday’s trading sessions.

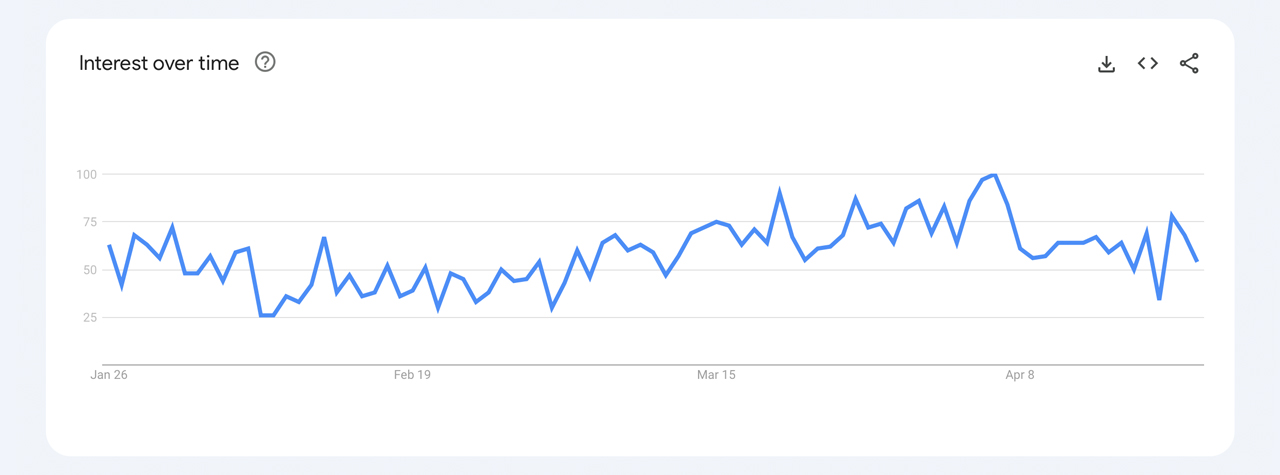

According to Google Trends data, the search query “how to buy gold” has been trending worldwide in the last 90 days. On March 20, 2023, the search term reached a score of 90 out of 100, followed by a peak score of 100 on April 6. As of now, the score for “how to buy gold” is hovering at 62, according to Google Trends data. The search term has generated significant interest in regions such as Singapore, Australia, St. Helena, the United Arab Emirates (UAE), and Canada.

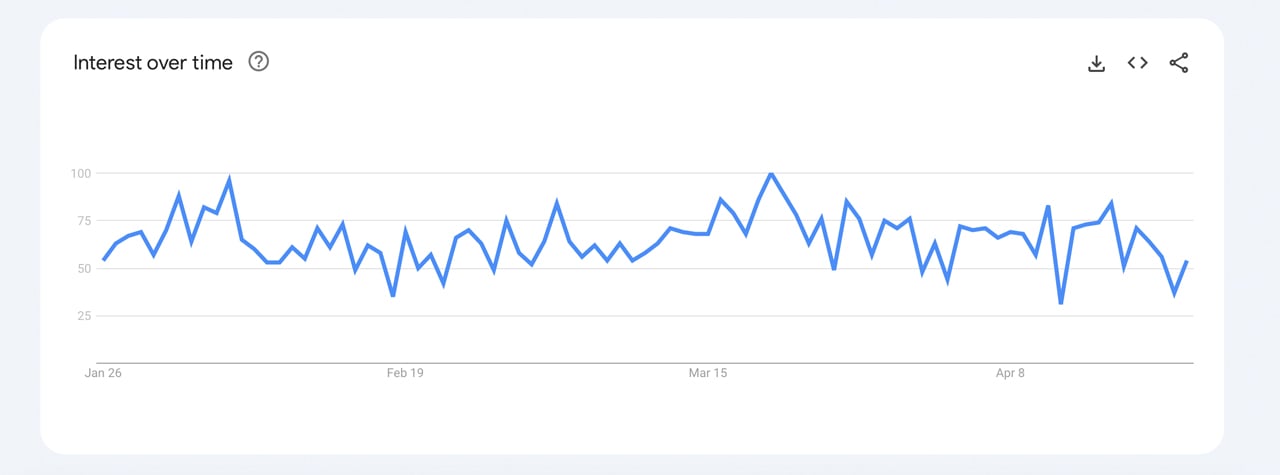

Worldwide data from 2004 to the present day indicates that the “how to buy gold” search term has an 85 out of 100 score, with its last peak score of 100 recorded in August 2011. In addition to gold, Google Trends data shows that interest in the search term “how to buy bitcoin” has also risen, reaching a high score of 100 on March 20, 2023, based on 90-day statistics. Bitcoin.com News reported last week that in mid-March and into April, the search query “bitcoin” was also on the rise.

Furthermore, the failure of three major U.S. banks, namely Silvergate Bank, Silicon Valley Bank, and Signature Bank, in mid-March triggered a spike in searches for terms such as “banking crisis” and “bank runs,” as reported by Bitcoin.com News on March 19, 2023. The very next day, “how to buy bitcoin” achieved a score of 100, having come close on February 5, 2023, when it reached a score of 96 out of 100. Current interest in the term “how to buy bitcoin,” according to 90-day Google Trends statistics, stems from regions like Nigeria, Guam, Cameroon, St. Helena, and Mauritius.

What are your thoughts on the increasing interest in buying gold and bitcoin? Share your opinions about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.