As the highly anticipated US Consumer Price Index (CPI) data for June is set to be released today at 8:30 am EST, the Bitcoin (BTC) market finds itself at a crucial crossroads. With inflation concerns lingering and the Federal Reserve’s next moves under scrutiny, market participants eagerly await the impact of the CPI figures on BTC’s price trajectory. The expectations are as follows:

- Headline y/y at 3.1% (last 4.0%)

- Headline m/m at 0.3% (last 0.1%)

- Core CPI y/y of 5.0% (last 5.3%)

- Core CPI m/m of 0.3% (last 0.4%)

The Fed’s Battle Against Inflation

In recent months, inflationary pressures have been a cause for concern, capturing the attention of investors and economists alike. While headline inflation is cooling off fast and expected to fall further to 3.1% (from 4.0% in May), it is the core CPI, which excludes volatile food and energy prices, that has become increasingly important.

In recent public appearances, members of the Federal Reserve (Fed) have maintained a hawkish stance and expressed concerns about a potential resurgence of inflation regarding the elevated core inflation. The underlying concern stems from the fact that inflation has primarily declined due to resolving supply chain problems, while core inflation remains elevated.

The rise in wages could contribute to a cycle of increasing sticky core inflation. Although core CPI was at 5.3% in May, experts now anticipate a gradual decline to 5.0% in June. While this is progress, it shows how sticky core inflation currently remains. An unexpectedly sharp drop would therefore be extremely bullish.

Any number below expectation could lead to a rally in the Bitcoin and cryptocurrency markets, as Christopher Inks, renowned trader and psychology coach, tweeted:

CPI will be released with a large expected drop from 4% last time to 3.1% expected this time around for the headline number. If core CPI comes in below 5%, that would be huge, and you better hold onto your britches. Will used car sales send core down much greater than expected?

A surprise in core inflation could have a significant impact on the next rate hike decision by the Fed. The next FOMC meeting is on July 26. At the moment, the CME FedWatch tool predicts with 92.4% a 25 bps rate hike which is holding back the markets. This probability is likely to drop massively if the core CPI surprises to the downside.

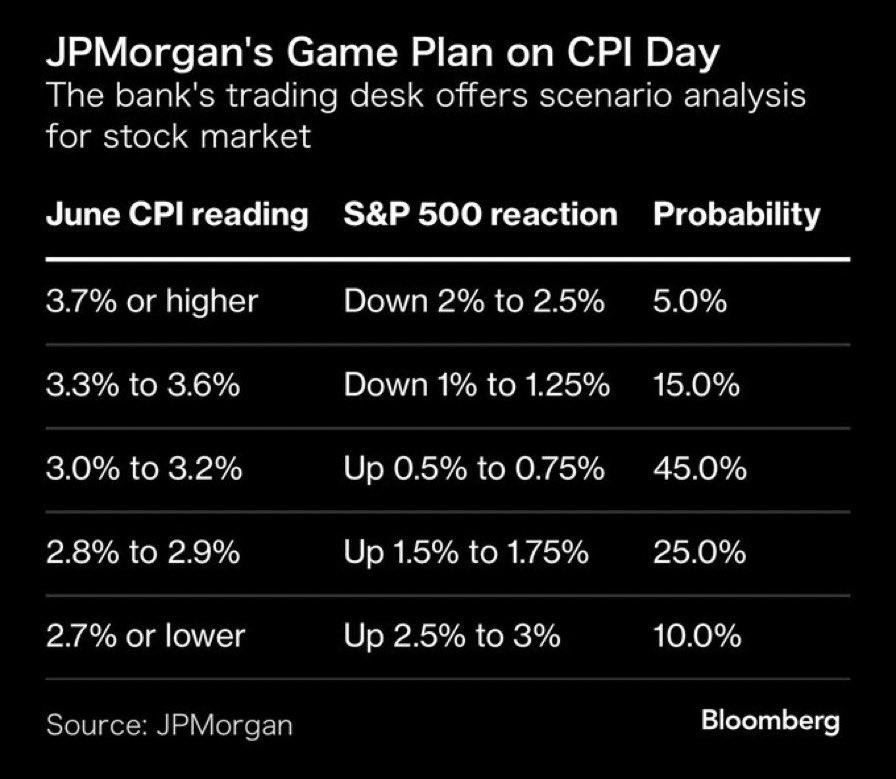

As usual, JP Morgan has drawn up a game plan for the S&P 500 in view of today’s release of the Consumer Price Index. According to the banking giant, a drop in the CPI to 3%-3.2% has the highest probability at 45%. The S&P 500 could then gain between 0.5-0.75%.

The second-highest probability is given by JP Morgan to a drop in the headline CPI to 2.8% to 2.9% (25%). In this case, the S&P 500 could rise by 1.5-1.75%. Moreover, the banking giant gives a 10% chance to a fall of the CPI to 2.7% or lower, while a surpassing of the forecasted reading (above 3.3%) is just at 20%.

Potential Scenarios For Bitcoin

If the CPI figures come in higher than expected, signaling elevated inflationary pressures, BTC could face a temporary retreat. In the case of CPI falling within the predicted range, BTC’s response may be moderate. Investors will closely monitor the data for signs of sustained inflation, potentially resulting in a slight dip in Bitcoin’s price.

A lower-than-anticipated CPI figure, suggesting easing inflationary pressures, could ignite a bullish rally in BTC. Investors may perceive this as a positive signal which is signaling a continued rate pause by the Fed. A lower-than-expected core CPI reading has the potential to provide a much-needed boost for Bitcoin.

At press time, the Bitcoin price has managed to break above the mid-range resistance, trading at $30,767.

Featured image from iStock, chart from TradingView.com