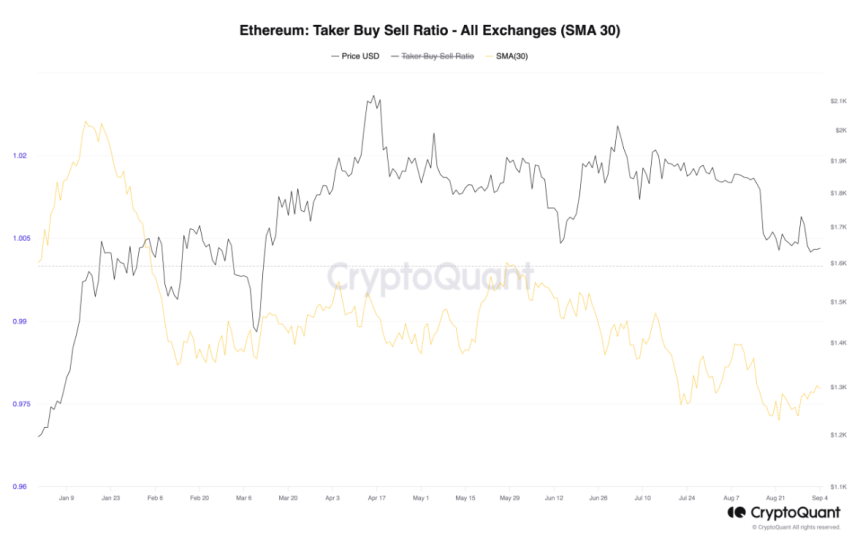

The Ethereum (ETH) market has been gripped by escalating bearish sentiment as the taker buy-sell ratio, a critical indicator of market dynamics, plunged to a yearly low. This downward trajectory has sparked concerns among investors and traders, highlighting the prevailing pessimism in the Ethereum futures market.

ETH’s taker buy-sell ratio, as revealed by a recent report from the anonymous CryptoQuant analyst Greatest_Trader, has been on a consistent decline over the past few months. The ratio reached its nadir at the end of the previous month, signaling a growing dominance of bears in Ethereum’s trading arena.

Greatest_Trader said:

“This consistent behavior underscores the dominant bearish sentiment among futures traders participating in Ethereum’s market.”

The dwindling taker buy-sell ratio is indicative of increased sell orders, reflecting a lack of confidence in the coin’s short-term prospects.

Source: CryptoQuant

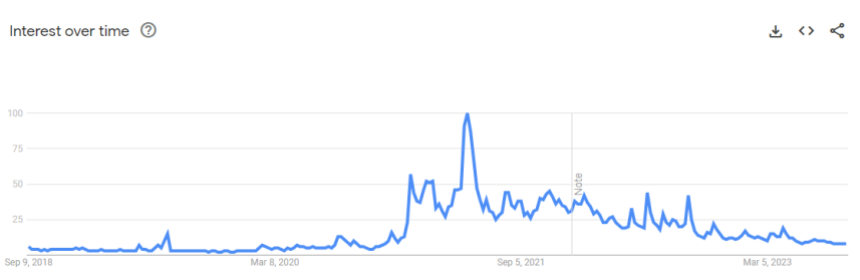

Google Trends Reflect A Loss Of Interest In Ethereum

Adding to Ethereum’s woes is the declining interest of mainstream internet users. Google Trends data indicates that the number of searches for Ethereum (ETH) has plummeted to levels not witnessed since November 2020. Even more strikingly, searches for “DeFi” have dipped to four-year lows.

Source: Google Trends

In the last seven days, the metric for “Ethereum” plummeted to a dismal 8/100, a level last seen during the crypto euphoria of 2021, where internet users were searching for Ethereum 12 times more frequently. This decline in interest signals a significant loss of confidence in Ethereum’s prospects among retail investors.

ETH Futures Open Interest Hits Yearly Low

The pessimism surrounding Ethereum is further underscored by an examination of its futures open interest. Currently standing at $4.67 billion, ETH’s open interest has reached its lowest point this year, marking a 36% decline since its peak on April 19.

This drop in open interest reveals that institutional and retail traders are increasingly skeptical about the cryptocurrency’s short-term potential. As of now, Ethereum’s price hovers at $1,622.75, with a 0.6% decline in the last 24 hours and a 1.9% loss over the past seven days, according to CoinGecko.

Ethereum (ETH) is currently trading at $1,620. Chart: TradingView.com

Ethereum’s once-promising outlook is facing headwinds as bearish sentiment prevails in its futures market. The declining taker buy-sell ratio, coupled with a lack of interest from retail users, paints a somber picture for the cryptocurrency. Moreover, the dwindling open interest in Ethereum’s futures suggests that traders are hedging their bets amid growing uncertainty.

Ethereum’s journey in the coming months will undoubtedly be a challenging one, and investors and enthusiasts alike will be keenly watching to see if it can weather this storm and regain its bullish momentum.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Vauld