[ad_1]

The last 12 months have been tough on digital currency investors as the crypto winter has caused a large sum of value to leave the once-bustling economy. The privacy coin economy, for instance, shed more than 55% against the U.S. dollar as it dropped from $11.7 billion in Jan. 2022 to the current $5.22 billion.

Privacy Economy Loses 55% Against the Greenback, European Union Looks to Ban Anonymizing Cryptos

Privacy coins are not talked about like they used to be. These days, the hype and discussions surrounding decentralized finance (defi) and non-fungible tokens (NFTs) have eclipsed privacy coin conversations.

Furthermore, during the last 12 months, the privacy coin economy has dropped from $11.7 billion to today’s $5.22 billion. Last January, the top two privacy tokens included monero (XMR) and zcash (ZEC).

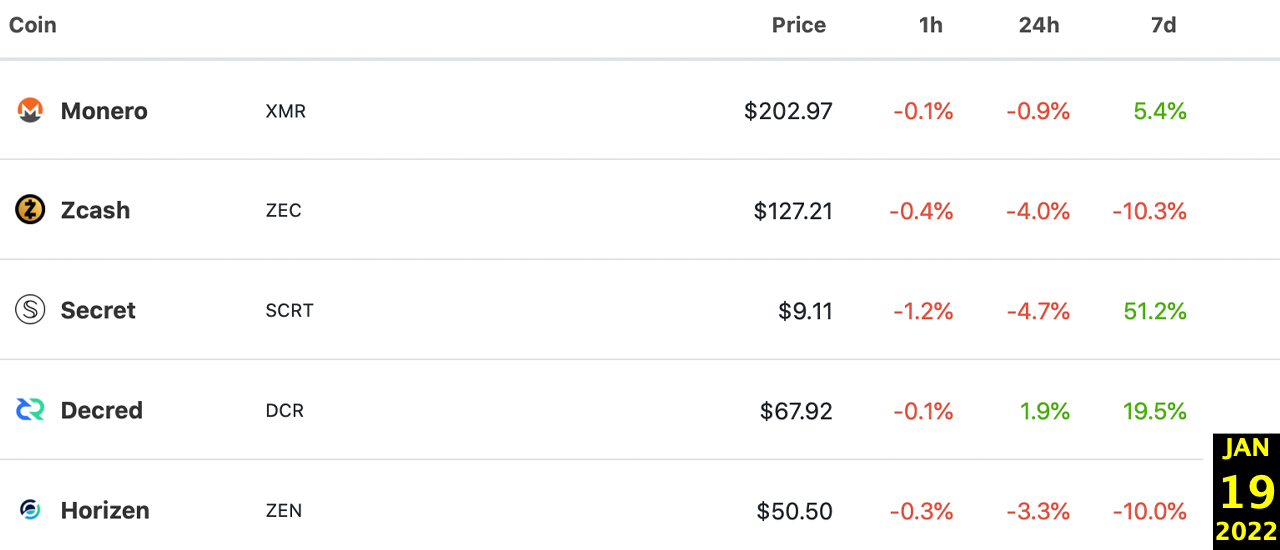

At the time, monero was the largest privacy coin by market cap and still is today. In Jan. 2022, XMR’s price was around $202.97 per unit and it had a market valuation of around $3.66 billion on Jan. 19, 2022.

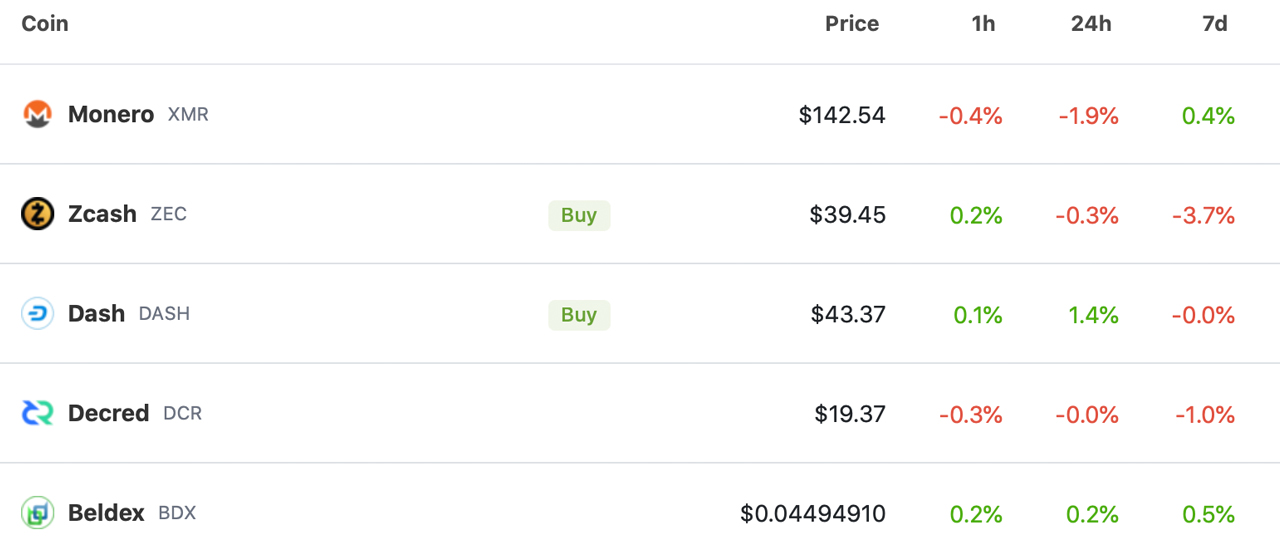

Today, XMR is exchanging hands for around $142.35 per coin and it has an overall market capitalization of around $2.58 billion. Zcash holds the second-largest privacy coin market valuation this year and in January it was around $1.53 billion.

At the end of Dec. 2022, ZEC’s market cap is down to $517 million. Jan. 2022’s top five privacy coins by market cap included monero (XMR), zcash (ZEC), secret (SCRT), decred (DCR), and horizen (ZEN).

December 2022 stats show the top five privacy coins include monero (XMR), zcash (ZEC), dash (DASH), decred (DCR), and beldex (BDX). XMR’s and ZEC’s market caps equate to roughly $3.1 billion which is 59.4% of the entire privacy coin economy.

In Jan. 2022, XMR and ZEC were valued at $5.19 billion and represented only 44.36% of the entire privacy coin economy. Today, the top two privacy coins by market cap have a lot more dominance.

Last month it was reported that leaked EU plans could ban privacy coins like XMR, ZEC, and DASH. “The European Union could ban banks and crypto providers from dealing in privacy-enhancing coins such as zcash, monero, and dash under a leaked draft of a money laundering bill obtained by Coindesk,” the publication noted on Nov. 15, 2022.

Government policy decisions and proposed guidelines have caused a number of crypto exchanges worldwide to stop listing privacy coins like XMR and ZEC. The lack of listings gives privacy coins a lot less liquidity which makes them more susceptible to price fluctuations.

What do you think about privacy coins this year and their market performances during the last 12 months? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

[ad_2]

Source link