The bullish activity in the market has been on the decline due to external factors that have negatively impacted investor sentiment, especially Shiba Inu.

Specifically, the crypto market has suffered a significant setback following the US Federal Reserve’s decision to increase interest rates and the resurgence of concerns regarding banking crises.

According to the latest data from CoinGecko, the market has contracted by nearly 2% within the past 24 hours, indicating a clear downward trend.

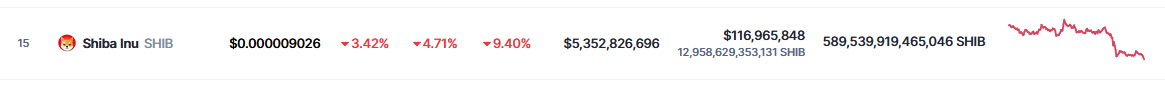

Source: CoinMarketCap

SHIB, one of the leading meme coins in the space, is currently flashing red in all timeframes. The latest market data reveals that SHIB is down nearly 5% in the current timeframe, showing investors that it is a must-avoid coin in the coming days. However, crypto whales have been accumulating SHIB according to recent reports.

Price Down, Whales Accumulate – What’s Up?

According to crypto whale tracker WhaleStats, the token is still the most traded token by whales. Recent news regarding this recent activity reveals that this accumulation might be part of a bigger investment strategy. In late March, the same whales sold over 500 billion SHIB before accumulating once more.

Whales also hold the majority of SHIB’s supply. Up to 31% of the total supply of SHIB is being controlled by 100 whales in the market. However, their accumulation was met by bearishness with SHIB going downward.

Source: WhaleStats

The token’s recent price movement can be explained by the market’s recent actions. Major cryptocurrencies like Bitcoin and Ethereum have been doing badly in the past few days. Despite Bitcoin facing a bullish break according to a Twitter analyst, SHIB’s current performance might be held back by developments outside of SHIB.

#Bitcoin Inexorable Breakout 💥🚀#BTC is about to break its monthly Bollinger Bands base line 🔴. And when that happens 1st target 🎯 will follow inexorably. That would bring #Bitcoin to a solid $63,500. pic.twitter.com/jMojWaS3eL

— Titan of Crypto (@Washigorira) May 5, 2023

Despite this, investors should keep an eye out for SHIB as it continues to mature.

Shiba Inu Investors Should Watch This Level

At the moment, the token is below the $0.0000096 resistance level. However, the price seems to stabilize below this level which may be indicative of a bullish breakout. If the bulls manage to break through $0.00000096, investors and traders could then target $0.00001098 comfortably.

However, investors and trailers should monitor how Bitcoin and Ethereum move in the coming weeks. Any bearishness within these markets can negatively affect SHIB’s price movements in the future.

SHIB total market cap at $5.5 billion on the daily chart at TradingView.com

Monitoring the macroeconomic situation will also benefit the bulls. May 10 will be the next date investors should pay attention to as this is the date when the Consumer Price Index data will be released. If the core CPI stays high or remains stagnant, we can expect the Federal Reserve to raise the interest rates in the coming months.

In the short term, investors should be wary of short sellers temporarily taking over the market. CoinGlass data shows that long buyers are outnumbered by short sellers by a wide margin. Keeping these in mind should keep SHIB’s profitability in the green for investors.

-Featured image from IT Business